Washington County News April 2025

$20.5 million gap anticipated in 2025-26 budget

The projected gap is anticipated in Washington County’s General Fund, the part of the budget that policymakers have the most flexibility over when it comes to spending decisions. Under Oregon budget law, the county must find ways to close the anticipated gap to balance the proposed budget for the new fiscal year that starts on July 1. Officials plan to share a balanced, proposed budget with the Washington County Budget Committee on April 28.

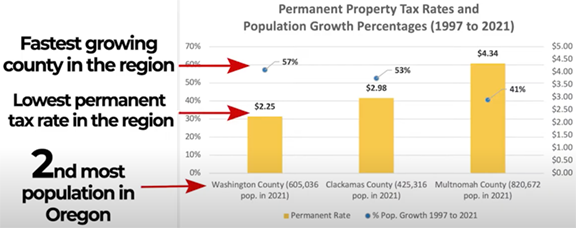

“Our ability to balance the General Fund continues to be constrained by limited property taxes and other discretionary revenues which no longer cover the cost of the community’s growing need for our services,” said County Administrator Tanya Ange. “This ongoing challenge means the cost of services is outpacing our ability to fund them through the General Fund.”

Washington County, which has the lowest permanent property tax rate among the counties in the Portland region, has needed to make budget-balancing cuts for the past four years. The county’s departments and offices were instructed earlier this year to provide reduction scenarios at the 10%, 13% and 17% levels. County leaders will choose from some combination of these reduction scenarios to build the proposed budget to be released on April 28.

“We have sought to preserve services as much as possible that the community relies on. Although we are continuing this approach again for a fifth year in a row, there is now no other place to turn than to consider eliminating some services altogether,” said Ange.

Washington County is not alone. According to this article from Oregon Public Broadcasting, nearly 60% of Oregon counties are facing similar budget shortfalls. “Pandemic-era federal funds that buoyed local government services have largely dissipated. Government revenue, which primarily comes from property taxes, has not kept up with inflation and rising personnel costs. Meanwhile, federal funding—once a reliable source of money for Oregon governments—could see changes under the Trump administration.”

Washington County leaders are also beginning to explore additional sources of revenue as the FY 2025-26 budget is being built. Temporary increases in property taxes, called local option levies, are anticipated for property tax measures supporting library and public safety services that expire in 2026. Increased fees for other services are also being considered for future years.

Members of the public are encouraged to participate in this year’s budget process in a variety of ways: Review the Fiscal Year 2025-26 Proposed Budget Summary when it is posted to the Washington County website on April 28. Attend any of the budget meetings or public hearings virtually and provide comments at designated times. The public may also attend in person at the Charles D. Cameron Public Services Building Auditorium, 155 N. First Avenue in Hillsboro. Meetings will also be livestreamed from the County’s YouTube channel.

Nurse Navigation Program now available

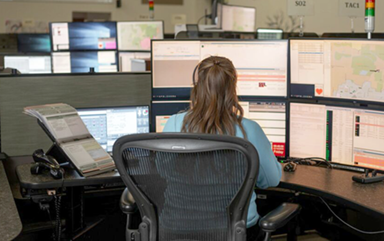

The Nurse Navigation program, launched on March 4, allows 9-1-1 dispatchers to connect certain callers with nurses who will navigate them to the most appropriate care using medical protocols. This ensures that Emergency Medical Services resources are available for potentially life-threatening situations such as heart attacks or strokes while still addressing all callers promptly and effectively.

“Not every 9-1-1 call requires an immediate response. This program helps ensure patients with life-threatening emergencies receive immediate attention, while those with non-life-threatening needs are directed to appropriate, cost-effective care.” said Brian Henricksen, the project integration director at Global Medical Response (GMR), the parent company of AMR that supplies ambulance services to the county. “This approach enhances patient care and optimizes resource allocation across Washington County’s health care ecosystem.” Learn more on the WashCo website here.